News

In this section, you will find news about THEnergy. We inform you about the most important developments.

Donald Trump’s arbitrary foreign policy results in a renewables-peak for industrial offtakers in Africa

THEnergy not only sees an increasing number of onsite renewable projects, but also observes an increasing downstream consulting demand, mainly from mining companies

Munich (Germany), September 2018 – In recent months, oil prices have been rather unstable. To some extent this has been related to Donald Trump’s foreign policy – mainly in respect to Iran. Oil and as a consequence also global diesel market prices have become very volatile with a tendency to increase long-term.

In Africa, many remote sites are powered by diesel or heavy-fuel oil (HFO). This not only applies for mines and factories but even for large metropolitan regions. For industrial off-takers and utilities, recent diesel price developments are critical. Fuel represents one of their main operational costs. Price increases have direct adverse effects on their business. Even higher volatility represents a major concern by affecting plannability.

Solar power does not display a high level of volatility. Today’s investments determine the electricity costs over the next 20-25 years. Industrial consumers often do not have to invest their own capital. It is sufficient to sign power purchase agreements (PPAs) with third party investors that finance the solar power plants and sell electricity.

THEnergy sees in its daily consulting practice that renewables are becoming more and more established in African power markets. Even traditional fossil fuel companies like diesel suppliers, diesel genset providers and rental companies have been changing their business models by integrating renewable energy solutions. Today, in Africa many offtakers specifically ask for combinations of diesel and solar before signing or prolonging their diesel supply contracts. In solar-diesel hybrid solutions, solar energy is used to reduce diesel consumption. Most of the large-scale projects still do without energy storage systems and rely on solar only during daytime. Falling battery prices will gradually add more and more energy storage in solar-diesel hybrid solutions and increase the renewable energy share in the system until finally all the energy will come from renewable energy sources: “solar-diesel hybrid” would turn into pure “solar-plus-storage”.

“On paper, replacing diesel by solar in remote locations has made sense for years,” adds Dr. Thomas Hillig, managing director at THEnergy. “However, temporarily low oil and related diesel prices were a major issue. These unintentional effects of US foreign policy are tipping the scales at the moment. No one expects stable framework conditions in the near future. We see a high consulting demand from downstream stakeholders, mainly from remote offtakers such as mines and also from fossil fuel companies.”

THEnergy-Nuance Energy Report: Optimized mounting systems enable shorter solar power purchase agreements in the mining sector

An innovative earth anchor-based approach minimizes the environmental impact of solar, reduces costs, and increases relocatability of PV plants.

The new NUANCE ENERGY-THEnergy Report “Modular, semi-portable mounting systems for solar in the mining sector” focuses on a product innovation that has several advantages for remote off-grid mines. This is mainly due to the fact that the solar systems are built next to the mining off-takers. For mines in production and even more so in mining exploration, the lifetime of the solar system often does not correspond to the need for power at a specific location. Mining camps are relocated rather frequently, and mines at production stage often have a planning horizon below the 25-year lifetime of the solar power plant. This might be due to deposit sizes, mining permits, or economic reasons. In the case where independent power providers supply the solar electricity through a power purchase agreement (PPA) to the mine, this translates into a counterparty risk. Even if the mine operators have committed long-term, the economics of the mine must ensure that the solar energy is actually paid. If the client fails to pay, typically there are no other off-takers at these remote locations.

Optimized mounting systems allow for dissembling, relocating, and re-erecting the solar array in a different location. The earth anchor approach is one of the most advanced solutions because it also reduces installation costs and environmental impact. In the Osprey PowerPlatform technology, earth anchors secure the foundations of ground-mount solar arrays to the underlying terrain. Earth anchors can be deployed in a wide variety of substrates as they work in virtually any type of soil, on any site—even under the most challenging of conditions, such as in desert hardpan, rocky soil, permafrost or on most landfills. The earth anchor, once positioned, relies on an upward radiating cone of soil which may weigh as much as 2000-3000lbs (1000-1500kg) of resistant force. The earth anchor approach has several advantages over traditional foundations. Less material use means lower direct costs and transportation costs. The Osprey PowerPlatform eliminates the need for large scale utility vehicles such as cement trucks and pile driving machines as it installs to the ground with basic tools that one man can carry, handle and operate. The simplicity of the solution results in shorter installation times and lower labor costs, and greatly reduces the amount of skilled labor needed.

For mining applications, these advantages translate into overall cost-savings for constructing the solar power plant. Lower costs for relocatability means that shorter power purchase agreements become economically viable. “For remote applications, the advantages of our system are even bigger than for standard solar plants. Therefore, we see an excellent fit for our solutions in off-grid mining”, explains Brian C. Boguess, Nuance Energy’s CEO.

“One of the main obstacles for solar power in mining is that miners struggle to commit to long term PPAs. Flexible mountings systems such as the Osprey PowerPlatform are crucial for shorter PPAs,” says Dr. Thomas Hillig, Managing Director of THEnergy. An interesting aspect is that earth anchors have been successfully used in mining applications for providing the foundation of fabric buildings.

For further information and detailed results, please have a look at the report: https://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

Rural electrification companies being targeted by commercial investors

THEnergy sees the need for shortened due diligence processes and has developed a streamlined approach

Globally, around 1.2 billion people do not have access to electricity. Cost erosion in solar, wind, and energy storage technology is creating new opportunities for the electrification of rural areas. On the solution side, two main segments can be distinguished: solar home systems and mini-grids / microgrids. Solar home systems are self-sufficient solutions for individual households. A small solar system is typically coupled with a battery to provide power for DC appliances day and night. Mini-grids may provide DC power or more sophisticated AC power through a semi-centralized system at the village level. Intermittent renewable energy from solar, wind or hydro solutions might be balanced by integrating energy storage, biomass or diesel generators. Pay-as-you-go (PAYG) solutions allow for innovative business models with mobile payment options.

In the last few years, the appetite for investing in these segments has been growing from impact and commercial investors.

At the same time, utilities like E.ON and ENGIE have built up mini-grid capabilities from scratch. Technology firms such as Facebook and Microsoft support mini-grid development: they have set up the Microgrid Investment Accelerator – a USD 50 million support vehicle. Finally, foundations like the Shell Foundation and the Rockefeller Foundation foster mini-grid improvement. These activities have triggered interest from many new investors. Sometimes, a gap between the status quo and expectations is apparent. Typically, investors realize this within rather costly due diligence processes. Rural electrification companies must also take significant efforts to collect and present relevant information that is tailor-made for the needs of investors. In addition, they are required to disclose a significant amount of information during the process.

THEnergy has been consulting investors in rural electrification-related due diligence processes lately and has developed a streamlined approach that will significantly cut costs on both sides. “The objective is to make the process for future due diligences more efficient and to reduce transaction costs,” explains Dr. Thomas Hillig, Managing Director of THEnergy. The new methodology is based on the experience that, typically, a few factors are critical during the acquisition process. “Before the main process starts, we also provide detailed market information to investors which helps to manage their expectations and to select investment targets that correspond to their needs”, continues Hillig. The new approach will make funding for mini-grid players more cost-effective and will contribute to quicker growth. It can also be applied similarly to evaluate and optimize existing investments in mini-grid players.

March 2018

Rural Electrification Mini-grids to Become a Huge Energy Storage Market

New investments from companies such as Shell, Engie, Mitsui, Total, and Caterpillar will boost the energy storage market in the rural electrification segment to up to 50 MWh annually – in the long-term, 1 GWh per year will be possible.

THEnergy releases new analysis based on 22 expert interviews with decision-makers from mini-grid developers and energy storage providers mainly covering markets in Africa and Asia. Until recently, development finance institutes (DFIs) and impact investors had invested in renewable energy based rural electrification. This has changed with the recent investments of Shell, Engie, Total, Mitsui, and Caterpillar which have also turned the segment into a serious business opportunity for energy storage providers.

In rural electrification applications, lead-acid batteries were traditionally used. The objective was to build first mini-grids at the lowest total cost to demonstrate the viability of the business model to potential investors. Additional risks such as from new lithium-ion storage technology also were to be avoided.

The decreases in cost of lithium-ion batteries are changing the situation. The difference regarding the total cost of ownership is tightening. The gap is often sufficiently small to swap to superior lithium-ion technology. In many cases, only capital constraints make private mini-grid developers opt for low CAPEX lead-acid batteries. Most of the mini-grid developers interviewed expect to pursue the technology shift within the next two years. Many also have stated that they would be interested in training from storage manufacturers.

It can also be observed that many developing target countries of rural electrification have, so far, no experience with lithium-ion batteries. This could lead to unexpected costs regarding export or transport. For example, in Kenya and Tanzania, lithium-ion batteries are subject to PVoC (Pre-Export Verification of Conformity) procedures.

First developers already use lithium-ion batteries to ensure that the plants they are building right now will still be viable in the future when the full cost degression potential of the new technology will have been realized. Other energy storage technologies such as flow-batteries so far do not play an important role in this segment. Despite a good fit from a technical point of view, further cost cuts are needed to make flow technology economically viable in rural electrification.

Amongst the main markets for energy storage solutions in the mini-grid segment are India, Nigeria, Tanzania, Kenya, Uganda, Mali, Ghana, Indonesia, Bangladesh, the Philippines, and Haiti. “The recent investments in rural electrification will enable the construction of several hundred mini-grids per year. The market segment will finally come to life – also from a commercial perspective,” predicts Dr. Thomas Hillig, Managing Director of THEnergy, a consultancy specializing in off-grid power generation. “In the short-term we will see an annual market potential of 50 MWh – in the long-term this could raise to 1 GWh. Storage manufacturers should consider entering this market early.”

October 2017

THEnergy-IPS report: Solar, Energy Storage and Intelligent Energy Conversion Units Make Safari Lodges in Africa Green

Solar energy cuts the electricity bill of game lodges and reduces emissions.

Safari lodges are normally located in pristine nature, far away from civilization. They are often not connected to the national grid and generate power on-site using diesel generators. Diesel power is flexible, but also has various disadvantages such as has high costs, partly due to transport, and a significant ecological impact, mainly CO2-emissions, local hazardous exhaust gases, and noise. In solar-diesel hybrid applications, solar is combined with diesel generators for reducing diesel consumption. The new THEnergy-IPS report entitled “Hybrid Solar Mini-grids for Remote Safari Lodges in Africa” shows that as a result, costs are reduced, and both noise and emission levels are improved.

Air conditioning, fans, fridges, freezers, dish washers, washing machines, pumps, lighting, television, radio, phone and camera charging, and heating are among the main sources of energy consumption at safari lodges. Power is needed around the clock, with a peak during the middle of the day and in the early evening. Typical safari guests are rather demanding regarding stable electricity supply. Although green efforts by safari lodges are supported, normally guests are not willing to accept restrictions. A reliable and robust power supply is a basic requirement for safari lodges. Studies show that it contributes to high customer satisfaction. Hybrid controllers or energy conversion units are the key components for efficiently synchronizing the load with various power sources and energy storage, and will ensure a reliable power supply. In addition, solar power is often 50% (or more) cheaper than diesel power at remote safari locations.

“Our EXERON solution has been successfully used for military and telecom applications, two sectors with extremely high requirements regarding reliability”, explains Alexander Rangelov, CEO at IPS. “In addition, our customers honor our hot-swappable, plug & play approach, which saves significant costs during installations and for maintenance – particularly in remote locations.”

The power demand of game reserves might change over time, e.g. through lodge extensions or when their vehicle fleet is electrified. Modular approaches allow for adding additional solar and storage capacity at a later stage. The share of renewable energy can be increased for fully powering lodges with solar or wind energy plus storage 24/7.

“We see an excellent fit between safari lodges on the one hand, and solar and energy storage applications on the other. The first safari lodge operators like Wilderness Safaris, &beyond, Singita, and Kambaku have turned to powering their lodges with solar and storage. The biggest off-grid installation can reach a size of more than 400 kWp solar and 3.2MWh battery storage,” says Dr. Thomas Hillig, Managing Director of THEnergy. “Safari lodges are a very attractive target segment for solar and energy storage companies.”

The full report can be downloaded at: https://www.th-energy.net/english/platform-renewable-energy-on-islands/reports-and-white-papers/

August 2017

Successful PPAs for Solar-Diesel Hybrid Microgrids in Mining and Other Large-Scale Applications

THEnergy sees efficient power purchase agreements (PPAs) as the key success factor in the current booming market of reducing diesel consumption by renewables.

For traditional grid-connected applications, PPAs have been stream-lined over the years and are common practice now. Often, the main challenge is to adopt them to specific legislations.

In the last number of years, solar-diesel hybrid plants that aim to reduce the diesel consumption of remote commercial and industrial off-takers have become extremely popular. Mining is a pioneer in large-scale microgrids, but there is also an increasing number of renewable energy-based plants in other industries such as cement, food and beverages, textiles and salt. The technology has become mature; falling battery prices make the business case even more attractive. In the meantime, the first large-scale PPAs have been applied in this segment. However, the standard templates for grid-connected PPAs cannot be used as the framework is far more complicated.

One of the main challenges arises from the synchronization of generation and consumption. In the end, the off-takers often do not think in terms of buying a certain amount of electricity. Electricity is only a means for the purpose of reducing diesel consumption. This topic is normally also linked to measurement issues.

As the solar-diesel hybrid is a rather new field, many potential off-takers are not experienced and fear production losses which also need to be covered in PPAs. Other challenges stem from the fact that in many remote locations no alternative off-takers exist in case that the contract partner does not pay. Contracts cannot eliminate this risk completely, but mitigate it as far as possible. The worst-case scenario involves the off-taker having to file for insolvency. In the end, the renewable energy provider needs to conduct due diligence activities on the off-taker, both at the group level as well as on the specific operations that will be powered by renewables.

For the operation of hybrid plants, clear responsibilities between the parties have to be defined. Finally, many solar-diesel hybrid applications are built in countries with certain legislative risks that must be considered in the PPA. It is obvious that PPAs for solar-diesel hybrid plants are highly complex.

According to Dr. Thomas Hillig, Managing Director of THEnergy: “As a consultancy specializing in microgrids, we have been pushed by our clients to specifically cover the PPA topic. We have conceived workshops for optimizing PPA negotiations and also accompany our clients individually in the process. Our offer is aimed at both sides, renewable energy developers as well as commercial and industrial off-takers.”

For further information, please have a look at our workshops.

July 2017

One year of PV-battery diesel hybrid operations on a Caribbean island: THEnergy confirms the outstanding performance of the SMA microgrid

Island utility Stuco plans to expand plant and switch-off diesel generators in the near future

Our client, SMA Sunbelt, commissioned a 1.89 MW solar PV and 1 MW / 572 kWh Li-Ion battery energy storage system, in March 2016. The objective of the retrofitted renewable energy plant is to reduce the diesel consumption of existing diesel generators. THEnergy has performed a data analysis for the first year of operations. Large-scale hybrid systems are rather complex and for island utilities it is difficult to fully assess the outcome of hybridizing their diesel power plants with solar power plants on fuel consumption. They typically rely on the calculations of the manufacturers or on rather costly third-party studies.

In the case of Sint Eustatius, the performance of the plants exceeds the forecasts. The share of solar energy on the island energy mix was higher than predicted for the first year of operations. Relative diesel savings were 3.4% higher than forecasted: diesel consumption was reduced by 62 l/MWh instead of 60 l/MWh. These additional savings are particularly remarkable as solar irradiation during the year was 4.9% below average due to local weather conditions. Even the total savings in diesel were in line with those forecasted. This is also reflected in the slightly higher than expected performance ratio of the solar PV plant.

The analysis also shows positive findings for battery performance. While a degradation of 4% was expected, the actual degradation after the first year was 1%. It is realistic to assume that with normal weather conditions, and the extremely low degradation of the battery energy storage system, the future performance of the plant will be even better than during the first year.

The outstanding results of the new system are also the main reason for the island utility deciding to expand the plant in the near future by adding 2.25 MW of solar power, and 4.4 MW / 5.2 MWh of battery energy storage. As Fred Cuvalay, CEO of Stuco explained: “We are fully convinced of SMA Sunbelt, which is particularly important, as in this next step we will switch off our diesel gensets during sunny days and will fully rely on renewables”.

Thomas Hillig, the Managing Director of THEnergy also made the following comments on the exciting results: “Large PV-battery diesel hybrid plants are still relatively new. On islands in particular, the reliability of the supplier is a key success factor. Bad planning and technical issues may lead to huge consequential costs. This project will also be a signal to other islands of what can be achieved by integrating renewable energy.”

For further information and detailed results, please have a look at the THEnergy Analysis: https://www.th-energy.net/app/download/13556076824/2017JUL-THEnergy-Analysis_StEustatius_Final.pdf

May 2017

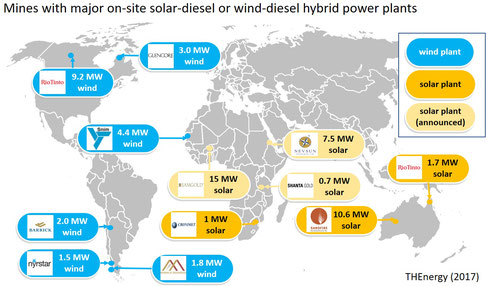

THEnergy Analysis: Solar-diesel and Wind-diesel Microgrids for Off-grid Mines Gain Momentum – New Projects Expected

Two recent project announcements show that renewables are an attractive solution for improving mining companies’ energy cost positions.

Iamgold has announced it is adding a new 12.5 MW solar PV plant to its Essakane gold mine in Burkina Faso. The Canadian company has signed a power purchase agreement (PPA) with the French independent power producer (IPP) EREN for an initial period of 15 years. The multinational Wärtsilä headquartered in Finland will integrate and build the solar plant.

Another Canadian miner, Nevsun, followed by announcing a 7.5 MW solar plant to reduce diesel consumption at its Bisha mine in Eritrea. Under a ten year PPA, Aggreko will provide a total of 29.5 MW of solar-diesel hybrid power to the gold and copper mine.

Africa and Australia are turning into “solar-for-mining hotspots”, while Canada and South America lead the development of wind-diesel hybrids.

“This upturn has become apparent during the last few months”, according to Dr. Thomas Hillig, managing director of THEnergy, a Germany based consultancy specializing in microgrids. “We have been observing the market closely for the last 3 years. In the past 12 months, more and more mining companies have become interested in renewables.”

Several factors contribute to this development. In the beginning, mining companies had serious doubts regarding the reliability of renewables. Various prototypes, some of them subsidized, some with and some without battery storage, have proven the concept of combining solar or wind with fossil power sources. In addition, brands known from conventional energy such as Caterpillar, Cummins, Aggreko, Wärtsilä, and ABB - that are active in hybrid markets - increase the trust in renewable energy off-grid solutions. Declining prices for renewables and energy storage have improved the business case for mines considerably. Mines also feel more comfortable entering long-term commitments of 10 years or more. Mining companies see that the advantages of renewables go beyond pure cost savings in that they could generate positive publicity and also position them as progressive toward investors. Internally, renewables have turned out to be an attractive platform for ambitious employees to qualify for further management challenges.

Maybe even more important are the lessons learned on the part of the renewable companies. They started to speak the language of miners and to understand the necessity of tailor-made solutions for individual mines. Renewable energy players have realized that many mines are not willing to invest their own capital or to commit to long-term PPAs that correspond to the physical lifetime of solar or wind assets. The formation of financing solutions for relatively short-term PPAs was crucial. This also calls for the emergence of a plan B in case that PPAs are terminated earlier or are not prolonged as expected. Solar companies in particular dedicate resources for making solar plants more flexible through semi-mobility concepts that facilitate their dismantling and redeployment at different locations. Finally, renewable energy players have started to apply modern sales and marketing tools to spread the message to mining decision makers.

“The newly announced projects will speed-up the uptake. If everything turns out well, mining companies could sign another 5-8 PPAs for renewable energy supply before the end of 2017”, says Hillig.

October 2016

PFISTERER/THEnergy study: Mobile solar/wind and storage solutions for reducing diesel consumption in the mining industry

The expert interview-based study shows how solar and wind microgrids meet the power generation requirements of the mineral exploration sector.

Mining or mineral exploration is the mining process of finding ores. Due to the remote locations, power generation for mineral exploration camps is particularly expensive. Typically, power is generated by gensets, and the diesel fuel needs to be transported over long distances by truck or sometimes even by helicopter. The cost of solar and wind energy has declined dramatically over the last decade. Renewable energy could potentially contribute substantial cost savings in comparison to diesel power.

The new study “Mobile Solar and Wind Diesel Hybrid Solutions for Mineral Exploration” presents the analysis of the power generation requirements of the mineral exploration sector and identifies fields of application for renewable energy solutions. One of the main challenges consists of dealing with the relatively long lifetime of traditional renewable energy power plants. They are normally laid out for operations of 25 years or more. Mineral exploration camps typically cover only a relatively short part of the mining value chain. Power requirements are still low in comparison to the consequent extraction operations. Often, mineral exploration is performed by specialized exploration companies. Finally, at the exploration stage, there is no guarantee of finding enough mineral deposits to justify setting up a mining infrastructure. All the factors demonstrate that exploration companies have no interest in committing to 25 or more years of electricity supply at specific sites. Exploration companies require semi-portable, flexible solutions that minimize the effort of dismantling them and rebuilding them at a new location.

PFISTERER has developed a containerized microgrid solution tailored to the needs of the exploration sector. “Exploration companies want power solutions that they can be redeployed easily and that are reliable,” says Martin Schuster, Senior Advisor at PFISTERER. “For military applications, the requirements are similar. Our system has won a very competitive NATO tender and has been already applied successfully for the NATO Energy Security Centre of Excellence.”

An integrated storage component ensures the reliability of the system. It improves the power quality, allowing the shift of energy during periods with insufficient wind or solar irradiation. In the end, that allows the diesel gensets to be completely switched off for longer periods, increasing the share of renewable energy in the system. “The advantages of renewable energy use go well beyond pure cost factors. Exploration companies send a strong signal to the regulator which could be very useful for obtaining mining licenses,” Dr. Thomas Hillig, CEO of the Microgrid Consultancy THEnergy, pointed out. “In some cases, solar and wind energy in the exploration phase might also lay the foundation for renewable energy use in the consequent extraction phase.”

The study can be downloaded at http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

October 2016

Many new partnerships are forming in solar and wind microgrid markets

Microgrid consultancy THEnergy

sees increasing interest in strategic partnerships for both main segments of the microgrid market: remote solar- or wind-diesel hybrid and utility microgrids

Microgrids are one of the hottest topics in the renewable energy world. Solar and wind energy are changing the paradigms of electricity generation toward more decentralized solutions. The utility microgrid segment is mainly driven by autarky and reasons related to supply security, while solar- or wind-diesel hybrid microgrids are mainly driven by cost reductions. In remote locations, in particular, diesel is an extremely expensive source for electricity generation and renewable energy is typically competitive without additional incentives.

Recently, though more and more projects are being realized, the bottleneck is still on the market side. Many players have formed or are in the process of forming partnerships. “We see two main targets for these partnerships: market access and technology enhancement by pooling complementary solutions”, says Dr. Thomas Hillig, Managing Director of THEnergy.

On the technology side, ABB has teamed up with Samsung and Ideal Power with LG Chem and Aquion Energy in order to provide tailor-made microgrid solutions featuring energy storage systems. The inverter manufacturers Fronius and Victron have also joined forces in a strategic partnership for smaller microgrids. For larger plants, Schneider Electric has developed a control solution in cooperation with DEIF.

Sometimes the objectives of the partnership are twofold. For microgrids, Caterpillar has lined up with First Solar. From a technology perspective, Caterpillar covers diesel genset expertise, while from a market perspective, Caterpillar is a leading supplier in the mining industry – a key target sector of many microgrid players. First Solar contributes photovoltaics expertise. Sometimes the collaboration goes beyond pure strategic partnerships. The French utility ENGIE has invested USD 6 million in the California-based company Advanced Microgrid Solutions (AMS) targeting utility microgrids. The French oil and gas major Total SA has acquired majority and minority stakes in several renewable energy and storage companies that cover key aspects of the microgrid value-chain. Among the investments are Sunpower, Saft, Aquion Energy, STEM, LightSail Energy, EnerVault, Ambri, Offgrid Electric, Powerhive, and DP Energy. It will be interesting to see if Total SA intends to integrate these investments in the future.

“We have been working with several companies in screening the microgrid market landscape for potential partners and have assisted them in setting up partnerships. Especially for smaller players, strategic partnerships are an important vehicle for entering new markets”, says Hillig. “We are constantly looking at growing our network of microgrid players in emerging markets. At this stage, many of our European and American customers intend to access new markets through strategic partnerships. We also help them to design and implement these new partnerships. Often the beginning of a partnership paves the way for how successful the collaboration will be long-term.”

September 2016

THEnergy closes financing gap for mid-sized off-grid solar and wind power plants

Backed by a German investor, THEnergy will build a pipeline of solar- and wind-diesel hybrid plants, focusing on USD 1-4 million investments per site

Last year, THEnergy acquired a similar assignment from an international investor who focuses on large-scale installations. Investments of USD 12-18 million per project were identified as the “sweet-spot.” “In the project screening process, we have come across many projects that are actually smaller,” points out Dr. Thomas Hillig, Managing Director of THEnergy. In the market, we see large-scale project sizes above all in the mining industry. Many mining companies have started to investigate renewable energy options for powering their mines. Several reference projects have shown that the technology for integrating solar or wind power into existing diesel gensets is mature. Various new projects are currently being examined. Due to the global mining crisis, this market segment actually is developing slower than expected.

“The business case for powering remote mines by solar and wind energy is still extremely attractive. Midterm, a wave of large-scale microgrid investments is to be expected,” explains Hillig. Short-term other market segments have developed faster. The installed base of diesel-gensets in small- and medium-scale applications is much bigger than for large-scale ones. Low diesel prices are also slowing down the large-scale PV projects in the off-grid market. At today’s storage price, low penetration renewable energy solutions are often the first choice. That means that for the same diesel genset often the size of PV and wind installations is not maximized, because pure economic criteria are more favorable for small- and medium-sized PV and wind projects. That, in conjunction with more favorable soft factors such as faster decision-making processes and higher attention to the environment than in mining, show that it is no surprise that the segment of small- and medium-sized projects is much more dynamic.

This segment consists amongst other applications of remote hotels, resorts, lodges, agricultural and other industrial fields such as cement, food, beverage or the infrastructure sector with hospitals, schools and shopping centers. Here sometimes renewable energy has a direct impact on the end-customer. Studies show that hotel clients value green efforts in the hospitality sector. In applications with a good visibility by end-customers, renewable energy creates additional value beyond pure cost savings. Here we also see that the renewable energy penetration plays a more important role and already today many projects include storage solutions. “In the small- and medium-sized segment, commercial and industrial players actively drive the topic of renewable energy forward,” observes Hillig. For investors who intend to build solar and wind power plants in the proximity of commercial and industrial off-takers and sell the energy on a PPA basis, this is a substantial advantage, as project acquisition costs are much lower than for slowly evolving large-scale mining projects. Due to high due diligence and financing costs, it is extremely challenging to handle mid-sized renewable energy projects for many funds.

“We are extremely pleased to have found agreement with a reputable renewable energy investor who has in the past already successfully financed projects in Germany and in international markets,” says Hillig. “We reach out to commercial and industrial end-customers and also to project developers in order to discuss the financing of off-grid solar and wind plants, reducing the diesel consumption of diesel power plants.”

THEnergy has been actively driving forward the complex topic of financing off-grid renewable energy power plants for several years. In 2014, THEnergy published the study “Solar-diesel-hybrid power plants at mines: Opportunities for external investors” which can be downloaded at http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/. In November, Dr. Thomas Hillig will chair the finance session at the Energy and Mines World Congress in Toronto.

August 2016

Hotels and resorts are pioneers for new renewable energy and storage technologies

THEnergy sets an additional strategic focus and assists hotels and resorts, as well as renewable energy companies, in identifying and evaluating hospitality sector-related opportunities.

The paradigm of power generation is changing, and an increasing number of decentralized small-scale cleantech solutions are evolving. For technology providers, the first reference projects are extremely important milestones of the market-entry process.

Hotels and resorts have often demonstrated their role as first movers for green technologies, and they can obtain advantages beyond cost savings by applying new cleantech technologies. A 2013 study by McGraw-Hill Construction, entitled “Green Retail and Hospitality Report - Waste Management” found that the core business of hotels, in general, is positively affected by green efforts. In addition, new cleantech technologies have considerable marketing potential and might allow hotels and resorts to gain an advantageous position in relation to a new target segment. The cleantech industry has steadily grown in recent years and has become economically important. For many employees within the cleantech industry, green commitment plays an important role during the private purchasing process.

Each hotel is unique and has different requirements. In addition, the cleantech industry is highly dynamic. THEnergy tracks technology developments and helps hotels and resorts to identify and realize solutions according to specific needs. “For windsurfing or kitesurfing resorts, new wind technologies might be more interesting than solar. For a desert resort, vice versa. For some island resorts, wave energy might be the preferred option,” specifies Thomas Hillig, managing director of THEnergy. “Several resorts have realized their first installations and are looking at increasing their renewable energy share. Typically, several solutions compete, such as integrating another type of renewable energy or storage.”

THEnergy also tracks the hospitality market thoroughly and helps cleantech players to identify sales opportunities. “In the hospitality sector, we see big differences in the readiness for renewable-energy commitment and willingness to be a first mover for new cleantech technologies,” adds Hillig. Some large hotel chains have dedicated cleantech departments, and some owners of smaller establishments are extremely eco-minded. “With our online platform for renewables on islands, we have already made a first step toward a particularly interesting sub-segment. We have learned that the economic framework conditions are extremely positive and that we, as a consultancy, due to considerable market intransparency, can add huge value for both – hotels and resorts and renewable energy players. This is why we are establishing cleantech for hotels and resorts as a second consulting focus – besides renewables for mining.”

Recent projects in the Maldives and Australia, where luxury resorts are fully powered by solar power plus storage, have created new dynamism in this sector and have increased the pressure on hotels and resorts that are not committed to cleantech.

For further information and plant examples, have a look at THEnergy’s platform for “Renewables and Islands”: www.th-energy.net/islands. THEnergy offer interested players within the hospitality and renewable-energy sectors several solutions ranging from introduction workshops to tailor-made market and technology information and opportunity identification.

July 2016

HeliosLite/THEnergy white paper: Disruptive 1.5-axis trackers improve on-site solar power generation for hotels and resorts

A development partnership with Club Med for HeliosLite’s first tracking system has provided valuable information for optimizing the novel energy solution for hotels and solar-diesel hybrid microgrids.

An increasing number of hotels and resorts generate at least a part of their electricity on-site with renewable energy power plants. The new HeliosLite/THEnergy white paper “1.5-axis tracker technology for auto-consumption of hotels and resorts” shows that a new tracker concept improves the energy yield and cost of electricity.

A development partnership with Club Med’s Europe – Africa Technical Department has given HeliosLite excellent insights into the requirements of the hospitality sector regarding solar power plants. As a consequence, the new tracking system is also optimized in respect of land use and movability. “In cooperating with Club Med, we have learned more about the electricity consumption of hotels and resorts. We are looking forward to also testing our disruptive 1.5-axis tracker with Club Med,” says Jay Boardman, CEO and Co-founder of HeliosLite SAS, who adds, “Our new trackers allow for increased power generation in the mornings and in the evenings when power consumption in most hotels is high.” Typically, air-conditioning, restaurants, lighting and pumping are the main-consumers of electricity at hotels and resorts.

The 1.5-axis tracker has not only proven its robustness in wind channel tests, but it is also easy to install and relocate. “We are looking at solutions that are flexible and cost competitive,” underlines Claude Blondel, manager of Club Med’s “Energy Mission”. “One of the objectives is to off-set local power outages with solar energy in regions where the grid is not stable.”

Numerous hotels and resorts are located in remote sites without access to grid electricity or in countries where the grid is not stable. Under these conditions, diesel generator sets are often used to generate electricity or provide back-up power for hotels and resorts. Electricity from diesel is typically very expensive and solar energy presents an excellent business case for reducing diesel consumption. More and more hotels and resorts are looking at generating green electricity with solar and wind power plants on-site. “This development is also triggered by factors beyond costs”, explains Thomas Hillig, managing director of the consultancy THEnergy. “On their holidays, tourists do not want to smell diesel fumes or listen to the noise of gensets. The pressure on hotels to turn toward green power is increasing.”

This white paper shows that the new 1.5-axis trackers can significantly contribute to this development. The solution is also interesting for other off- or weak grid solutions and owing to its scalability suitable for utility-scale solar power plants. For further information, have a look at the white paper: http://www.th-energy.net/english/platform-renewable-energy-on-islands/reports-and-white-papers/ or http://helioslite.com/site/wp-content/uploads/2016/07/2016JUL_HeliosLite-THEnergy_WhitePaper.pdf.

You find more information about HeliosLite on their homepage www.helioslite.com

June 2016

GIZ/THEnergy-Analysis: Momentum for solar-diesel hybrid microgrids in the Zambian mining industry

Load shedding, increased electricity rates for mining companies and a solar tender at 6.02US¢/kWh redefine the rules of power generation in Zambia

In recent years, an ongoing drought has caused a severe power crisis in Zambia. A new analysis from GIZ and THEnergy shows that the framework conditions for investments in solar have become more attractive. The power crisis has caused Zambia to take emergency measures at extremely high costs to close the gap between generation and electricity consumption. The mining industry is by far the biggest consumer of electricity in Zambia and is suffering greatly. Production is impaired by load shedding and power outages. Sometimes the only remedy is to use stand-by diesel gensets for baseload electricity generation. Power from diesel is expensive, and so is grid power for mines. At the beginning of the year, the rates for miners have been raised to 10.35US¢/kWh, with further increases expected—and this in a country that used to have an abundance of inexpensive electricity from huge hydropower plants. A sustainable improvement of this situation is not in sight, as some new power plants will be completed in the next few years, but at the same time, the output capacity of the Zambian mines is expected to double, as significant investments have been made in past years.

A recent solar tender by Zambia’s Industrial Development Cooperation for two 50 MWp solar power plants has caught the attention of the mining industry. The best offer was at US¢6.02/kWh, which is a significantly lower price than Zambia pays for emergency solar power and than mining companies pay for either grid or diesel electricity.

The analysis shows that local solar-diesel hybrid microgrids have become an interesting alternative. “We have also observed in other countries of the region that industrial players, such as mining companies, lose large amounts of profit due to an unreliable power supply,” says Tobias Cossen, Project Manager for Southern Africa at the German development organization GIZ. “In Zambia, the negative effects are twofold: severe production losses and higher electricity costs at the same time.” This development drives mining companies to become more self-sufficient. Zambia has excellent sun irradiation, which has a positive effect on electricity prices from photovoltaic (PV) power plants. “The recent PV tender comes at the right time,” adds Thomas Hillig, founder of the consultancy THEnergy. “It shows what development solar energy has made in the past few years; 6.02US¢/kWh is competitive with any kind of conventional energy, especially in a region that suffers from a lack of peak power during the day.”

Decentralized power generation in the form of solar-diesel hybrid microgrids has advantages beyond price. It allows for a robust power supply in off-grid or weak-grid areas, such as Zambia, where the grid sometimes poses severe reliability issues. In microgrids, solar power, grid electricity and diesel back-up power can be integrated. Typically, solar energy has priority in these power plants, as hardly any direct cost is associated with the operation of a PV system. The mines can invest their own capital or can secure long-term solar power supply through power purchase agreements with investors who build a PV plant and sell the electricity to the mine.

GIZ and THEnergy are offering to accompany companies in this transition phase and will present at the ZIMEC 2016 exhibition and conference in Lusaka on June 23/24, 2016.

For further details regarding solar-diesel hybrid microgrids in the Zambian mining market, please have a look at the analysis:

http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

April 2016

STEADYSUN / THEnergy white paper: Sky Imaging - A Competition for Storage in Solar-Diesel-Hybrid Applications?

An improved forecasting of weather changes will have consequences for the optimal specification and operation of renewable energy microgrids

Balancing the intermittencies in remote PV-diesel hybrid applications presents one of the most convincing business cases for energy storage. In the simplest case without storage, if clouds shade the PV array, then the load of the gensets is increased in order to provide the needed power. As traditional gensets can hardly be run below a minimum load of 30-40%, and have a ramp-up time of several minutes without storage, then gensets typically cannot be switched off as they need to provide spinning reserve for sudden solar irradiation changes.

The integration of storage allows for these gaps to be bridged while operating the gensets. This means that on sunny days the diesel gensets might be switched off and the share of PV in the microgrid can be increased accordingly. As power from diesel gensets is very expensive, especially in remote locations due to transport costs, the business case for solar plus storage is much better than for many grid-connected applications. If power drops caused by shading of the PV array can be forecasted precisely, then diesel gensets can be switched off during sunny days without using storage systems. The microgrid has to be conceived in a way that the solar plant forms the grid. STEADYSUN has developed a sky imager called SteadyEye, which takes hemispherical photos of the sky every minute. A proprietary forecasting algorithm calculates the possible impact of clouds on the PV production.

The influence is two-tier in regard to a possible integration of storage in solar-diesel hybrid systems, particularly in applications where shading occurs extremely rarely and where it is likely that sky imagers will crowd out storage solutions. More common will be the cases where sky imagers will be complementary and so optimize storage solutions. Forecasting weather patterns permits a parameterization of the microgrid that optimizes the number of generator starts and the use of the storage system. For example, if unsteady conditions are forecasted then we need to consider whether diesel gensets should actually be shut down and restarted frequently which has a negative influence on both, gensets and storage systems. A tailor-made solution can then take into consideration specific conditions on the generation side as well on the consumption side. In certain parameterizations, the risk of production losses can be driven down to virtually zero; for other systems with low consequences, such as stopping an air-condition system for a few minutes, this can be accepted in order to increase diesel reductions.

“Sky imagers add significant value to basically every PV-diesel hybrid system. The associated costs are extremely moderate,” explains Xavier Le Pivert, CEO of STEADYSUN. “Our innovative solution has been proved in several insular grid and off-grid applications. It can optimize investment costs and operating costs at the same time.” “Weather forecasting with sky imagers reduces investment and O&M costs in solar-diesel hybrid systems. This is another step toward more mature decentralized power generation. Every PV-diesel hybrid planer should be at least aware of this new approach,” says Thomas Hillig, CEO of THEnergy consultancy specializing in microgrids and hybrid power solutions.

The white paper can be downloaded at: http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

February 2016

Ripasso / THEnergy study: Renewables for mining go baseload with a hybrid fuel-solar solution

The combination of concentrated solar power (CSP) and gas or diesel allows for robust power generation in 24/7 applications with different fuel types incl. biogas and off-gas

The study “A hybrid solution with concentrated solar power (CSP) and fuel for baseload mining operations” analyses the fit of Stirling Hybrid solutions for the mining industry. The Stirling engine based solution combines in an integrated system solar with gas or diesel as an energy source. The CSP-solar component it relies on makes it particularly appealing for extremely sunny regions. In many mining regions irradiation is high and this criterion is satisfied.

The business case for Stirling Hybrid solutions is particularly attractive if mines are very remote. Transport costs and “losses” increase the fuel costs largely, whereas the CSP plant is installed once and then provides energy. New built off-grid mines face often choices of paying for expensive grid-connection or generating the power onsite. On-site power stations often consist of diesel gensets. Stirling Hybrid solutions are an attractive alternative to diesel gensets. If the solar irradiation is high the CSP plant can generate the total output power. If the solar irradiation is not at its maximum the heat that is needed for the highly efficient Stirling engine can also be produced by various secondary fuel types. This makes the fully integrated system ready for baseload applications as we see in mining. A variety of fuels can be used, e.g. natural gas, CNG, LNG, LPG, biogas, industrial off gas, coal methane gas or even diesel. A combination of CSP and biogas is 100% renewable energy generation.

In combined mining and metal processing plants off-gas that otherwise would be flared can be used in the Ripasso Stirling Hybrid solutions. It has extremely positive consequences on the sustainability and cost position. Further, the other gas types are cleaner than diesel or heavy fuel oil, especially if the high efficiency of the new hybrid solution is taken into consideration. The Stirling engine itself operates combustion free, which has many advantages regarding maintenance and operation of the power plant. The expected lifetime of the system is well above 25 years. The modular design allows for scalability in 33 kW steps and ensures a robust power generation, as the different power modules operate completely independently. The modularity of the Stirling Hybrid solution reduces the probability of production losses due to power outages to an absolute minimum. Finally, the study identifies advantages regarding the use of land and water. Both can be very critical for mining operations at remote locations.

“The Ripasso Stirling Hybrid solution fits very well to the requirement of mining companies whenever reliable baseload power is needed in sunny regions”, says Gunnar Larsson, CEO of Ripasso Energy. “We are frequently contacted by industrial consumers who suffer from production losses due to power outages.” The Stirling solution is proven in naval applications and units of the Ripasso CSP system are installed in Southern Africa. “It is important to indicate that Ripasso Energy belongs to Ahlström Capital, a family investment company that continues the heritage of the renowned Ahlström corporation”, points out Dr. Thomas Hillig, CEO of THEnergy. “A strong owner in dynamic environments is an important factor for long-term investments.”

The study can be downloaded at: http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

January 2016

A THEnergy and SolarPower Europe briefing identifies the key opportunities for solar companies to tap the potential of the mining sector for solar development

Ahead of the Energy and Mines conference in London on 28/29 January 2016, SolarPower Europe and THEnergy have teamed up to explore the opportunity of solar and mines for our sector. In a new briefing paper Dr Thomas Hillig and Dr James Watson examine the opportunity for solar companies in the mining sector. “Solar, storage and mining: New opportunities for solar power development” explores the growth of solar solutions in the mining sector and provides some outline advice for solar companies interested in engaging with the mining sector.

Solar is already used by grid connected and off-grid mines, and the phenomenon is growing. Mines are often very remote and have to deal with challenges regarding electricity price and reliability. In many locations, solar power is competitive with conventional energy for grid-connected applications, while solar power can cut costs for isolated mines. Several projects also show how energy storage solutions support solar penetration in combined solar-diesel-hybrid projects.

The growth of solar for mines provides new opportunities for the European solar sector, both in Europe and further afield. The briefing observes that industry specific marketing and an aligned solar industry approach are likely to increase the rate of penetration of solar into the mining sector.

You can find the briefing here:

http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

January 2016

Oil price dumping improves mining companies’ position regarding long-term renewable energy contracts

A THEnergy analysis exemplarily shows the mining sector why the timing is excellent for intensive energy consumers to commit to solar and wind energy

The price for crude oil is falling, and the diesel price is following. This development is triggered partly by the demand side, as China’s economy is not growing as quickly as expected. We can however see a more interesting development on the supply side. OPEC is sitting on the driver’s seat of the recent oil price tumble. The price of the OPEC basket of twelve crudes recently fell below USD 28.50 per barrel. A dumping-like strategy by OPEC seems to be aimed at preventing long-term investment by other oil producing nations. An oil price in the twenties means hardly a dozen nations can produce oil economically. Similar consequences arise for related energy forms, such as renewables.

In solar– and wind–diesel hybrid applications, the business case consists of partly replacing expensive energy from diesel with inexpensive solar or wind energy. As diesel prices are falling, the equation seems to be no longer valid. On closer examination, we see that mining companies that typically have huge energy needs for their production processes can actually take advantage of the situation. More and more investors are willing to finance large solar and wind power plants at remote mine sites and sell diesel reductions or electricity back to miners in so-called power purchase agreements (PPAs). When the oil prices were high, the investors were looking at much higher electricity prices in these long-term PPAs. High diesel prices gave the appearance that there was a large piece of cake to share between the mining company and the investor. In PPAs, the electricity price is often fixed over a period of 20 years or more.

Many experts see oil prices recovering very quickly because, amongst other reasons, OPEC leaders such as Saudi Arabia need the revenue from oil for their national budgets. Against this background, it is obvious that it is clearly in the interest of intensive energy users, such as mining companies, to lock in low electricity prices over a long period of time. Their negotiation positions for renewable energy PPAs have improved considerably through the recent oil price drop. Clever anti-cyclical decision-making often allows for high profits in the long term.

The business case for renewables at mine sites is often still very advantageous. Long-term investment decisions must take into consideration expectations about long-term developments. “In reality, we still see that more and more renewable projects are now being developed at mine sites,” observes Dr. Thomas Hillig, CEO of THEnergy. “At the same time, falling oil prices appear to be slowing the project implementation. Mining companies want to see considerable cost savings immediately.” With the current oil price development, it would very often make sense to commit to long-term PPAs even if renewable energy prices can only match diesel prices. The cost savings will come in later, as soon as the oil price recovers. If mining companies wait to make their decision, it is likely that they have to pay more for electricity from renewable resources – for the whole contract duration.

For more information about “Renewables and Mining” visit: www.th-energy.net/mining

November 2015

THEnergy sees mining companies prepare action plans against carbon measures at the Paris climate conference

Significant carbon charges would speed up solar-diesel and wind-diesel hybrid projects at mines and might boost storage applications.

Until very recently, there was little activity among mining companies regarding renewable energy. A recent report from CDP, formerly known as the Carbon Disclosure Project, came to the conclusion that the biggest miners are “unprepared for the transition to a low-carbon economy.” Nine out of the 11 analyzed large mining companies oppose new climate regulation. Only two appear to be “supportive of climate regulation.” For many mining companies, the main threat lies in new charges on coal. Only a few mining companies consider slowing or selling-off their coal-mining activities.

THEnergy has, however, realized that many of the large mining companies have started to focus on short-term actions regarding powering their mines. They prepare actions plans to react to carbon-reduction measures that might be adopted at the Paris climate conference. Large mining companies are working on a strategy for renewable-energy projects such as wind and solar power at their mines. Companies like Rio Tinto, Glencore, BHP Billiton and Goldfields have already finished their first pilot power plants or have recently announced new projects.

Energy typically amounts to approximately 20–30% of the operating costs of a mine. Strict carbon-reduction decisions at the Paris climate conference could have a strong influence on the cost position of mines. Mining companies that manage to adapt early to the challenges of a low-carbon economy could gain significant competitive advantages. In many cases, renewable energy is less expensive than electricity from conventional energy sources—even today, without any new carbon actions—especially for remote mines that are not connected to the grid and are powered by expensive diesel fuel.

“Mining companies are in the process of understanding that renewable energy can largely improve their competitive situation. Many miners struggle, however, to make the necessary decisions quickly as they face severe market challenges from falling commodity prices at the same time,” explains Dr. Thomas Hillig, CEO of the consulting firm THEnergy, which specializes in the topic of renewables and mining. “We are in a normal learning process, many mining companies have already understood that the prices of solar and wind power have decreased considerably in the last years. If significant carbon reduction measures are adopted at the Paris climate conference, we will see many solar and wind plants at mines in the very near future.” High carbon charges could even speed up the diffusion of battery-storage technology in order to increase the solar and wind share at the mines.

For more information about “Renewables and Mining” visit: www.th-energy.net/mining

October 2015

New momentum for off-grid renewables: EUR 200–400 million for solar- and wind-diesel hybrid and storage projects with a focus on mines

THEnergy signs a contract with an international renewable energy finance company to support in the development of a pipeline for off-grid projects

Munich, October 2015 – A renowned international finance company has mandated THEnergy to build a pipeline of off-grid renewable energy projects. Its subsidiary is establishing an off-grid fund with a planned EUR 100–200 million equity to invest. The equity is scheduled to be invested within an investment period of three years. Taking into account additional debt capital on a project level the finance company expects a total investment of EUR 200–400 million. To speed up the investment process, the investor is considering financing the entire project with equity in a first step and refinancing it at a later stage. The finance company can even use an existing renewable energy fund that is successfully investing in renewable energy assets in many countries, to acquire off-grid projects even before the new fund is established.

“We are looking at developed projects, but would also like to address intensive energy users that are not connected to the grid, source their energy from diesel power plants and are interested in decreasing their electricity bill,” explains Dr. Thomas Hillig, founder of THEnergy. One of the main barriers for diesel displacement projects with wind and solar was very substantial capex, which means that the energy bill had to be paid in advance. The fund will act as an independent power producer (IPP) and offer power purchase agreements (PPAs) to intensive energy users. In the past, the finance company has issued renewable energy funds that focused on investing in grid-connected projects, including PPAs for commercial consumers.

The fund has a global scope and the installations are supposed to be in off- or weak-grid areas. Mines and large, remote industrial customers have been identified as the main investment targets. The minimum investment is EUR 3 million with the sweet spot being EUR 10 to 15 million per project. The finance company estimates a double-digit return, with expectations varying for different countries, currencies and off-takers.

With the involvement of external investors, for mining companies and other energy-intensive off-takers, renewable energy becomes a standard electricity product that can be sourced in the same way as traditional energy – that means without initial investment costs into generating plants. THEnergy has already predicted this development in a study that was released in December 2014. “External financing of solar, wind and storage solutions at off-grid locations allows industrial off-takers and financial players to focus on their core competencies. In the near future, we will see many more off-grid renewable energy applications,” adds Hillig. An additional advantage is that external investors can reduce the relatively high off-taker risk at remote locations by financing several projects in a portfolio.

The study “Solar-diesel-hybrid power plants at mines: Opportunities for external investors” can be downloaded at

http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

October 2015

The other side of the Volkswagen scandal: THEnergy sees increasing pressure on remote hotels and resorts to replace diesel with solar and wind energy

Solar and wind can considerably lower health risks for tourists and employees at luxury resorts. At the same time, substantial electricity-cost savings are possible through solar and wind power.

The International Agency on Research on Cancer, which belongs to the World Health Organization, “classified diesel-engine exhaust as carcinogenic to humans in 2012 based on sufficient evidence that exposure is associated with an increased risk for lung cancer”.

Some of the nicest holiday resorts and hotels are situated in remote locations and are not connected to the grid. These hotels typically use dirty diesel generators for power generation. Due to the fact that it is difficult to access these remote locations, the diesel gensets are often not well maintained and are particularly hazardous. In many popular holiday destinations, there are no limits for genset diesel emissions. Exposure to exhaust can be a severe health risk for employees and tourists.

However, with solar and wind solutions having become very economical in recent years, there is an attractive alternative to using solely diesel gensets. In solar- or wind-diesel hybrid solutions, diesel consumption is considerably reduced by solar and wind power. Ideally, during the daytime, diesel generators are just used as back-ups. In many remote locations, costs for diesel electricity are particularly high due to transport. In today’s solar-diesel hybrid applications, solar and wind are often up to 75% less expensive than diesel electricity. Using storage is the next step. As battery prices continue to fall, it can make sense to completely switch off the diesel generators—even at nighttime.

The key barrier is that the electricity for solar and wind plants traditionally has to be paid beforehand. Investment expenditures are the main cost factor; during the lifetime of the solar or wind power plant, which averages 20–30 years, the fuel is free.

Innovative business models are evolving and changing these paradigms. “We work with external investors who are willing to make these investments and sell the solar or wind energy to larger hotels and resorts,” explained Dr. Thomas Hillig, founder of THEnergy. There are quite a view additional advantages of solar and wind at holiday destinations. Wind and especially solar power considerably eliminate or reduce the noise level in comparison to diesel gensets. Diesel transportation to islands is often an imminent danger for the environment. “We have seen diesel tankers sinking at landmark ecosystems such as the Galapagos Islands contaminating unique nature,” added Hillig.

In June 2015, THEnergy launched a platform for “Renewables on Islands” (th-energy.net/islands). It contains a database with renewable-energy applications on islands. Hotels and resorts are one of the most important segments. However, many hotels and resorts have not even considered solar and wind power yet. The Volkswagen scandal makes it clear that diesel is normally very dirty and can cause cancer. The awareness of tourists will increase. “We have seen some signals lately that more and more hotels and resorts are having a look at solar and wind solutions. The Volkswagen scandal increases the awareness of tourists toward the risks of diesel. We will see many progressive hotels and resorts that will invest right now in renewable energy,” pointed out Hillig.

The database “Renewables on Islands” is available at http://www.th-energy.net/english/platform-renewable-energy-on-islands/database-solar-wind-power-plants/

October 2015

Danvest/THEnergy study: flexible low-load gensets are a game changer in mining for solar–diesel hybrid solutions

The genset industry reacts to growing hybrid markets with a new approach that overcomes limitations of traditional gensets and reduces operating costs for mining companies.

Gensets are typically optimized for efficient operation at their optimal load points. In so-called solar–diesel hybrid applications, gensets balance the intermittencies from the solar plant – for example, when clouds shade the PV array. An attractive target for solar–diesel hybrid plants is the mining industry as power consumption is usually high and mines are typically in remote locations with high costs for diesel and for transport of diesel.

As the future market potential of solar–diesel hybrid solutions has become more explicit, the diesel genset industry reacts and has launched a first solution, which is specifically optimized for balancing solar plants. Danvest has introduced its Power Box solution with either CAT or Cummins engines inside. The traditional gensets are modified in a way so that they can run in low-load and operate in a reverse mode whilst hardly consuming any diesel, but with the full ability to respond quickly to output changes from the PV array or to changes in demand. On sunny days, penetration of the PV system can reach 100% while the diesel consumption is almost zero. At night, when the PV plant does not generate electricity, the low-load diesel gensets are run as normal diesel gensets and power the mine.

“Danvest low-load generators have been used in combination with wind turbines for years. As the solar–diesel market receives more attention than the wind–diesel market at this moment, we have adapted our field-tested solution for this very dynamic market segment,” explains Thomas Qvist Vestesen, CEO of Danvest Energy A/S.

The new study “Low-load Gensets for Solar–diesel Hybrid Plants in the Mining Industry” analyses the technical and strategic fit of low-load gensets for solar–diesel hybrid applications. It integrates several tests and verifies market-related questions through 21 expert interviews. In addition, several business cases are simulated.

The study shows that low-load gensets almost double the solar penetration rate in solar–diesel hybrid systems and that low-load diesel gensets are more efficient in hybrid plants, all this without the use of batteries or other storage systems. This straightforward solution has the potential to considerably lower the operational costs of mines. The fast spinning reserve of the low-load diesel systems in all its operations modes ensures the power supply in any case of variation of demand or of PV production losses, for example from shading.

“The demand for raw materials has slowed down and prices have decreased recently. The mining industry is facing substantial challenges. Reducing the costs of operations such as energy expenditures has become an important competitive factor. One of the game changers could be low-load diesel hybrid power plants giving maximal room to locally produced inexpensive solar and/or wind energy. Even at the current low oil prices, optimized hybrid technologies normally beat the current conventional diesel based electricity prices. The additional investment including the PV system has usually a pay-off period in the range of 4 to 7 years,” summarizes Dr. Thomas Hillig, CEO of THEnergy. “We see a big market potential for low-load gensets – especially in the mining industry as power demand is high and the market develops new dynamics – several companies report large pipelines of upcoming projects.”

The study can be downloaded at: http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

September 2015

Cronimet / THEnergy study: In solar for mines size does not always matter

Reducing CAPEX with energy efficiency and load shifting

Mining companies are constantly gaining interest in solar solutions because frequently solar energy is more cost competitive than conventional energy solutions – above all in remote locations that are not grid connected. CRONIMET Mining Power Solutions GmbH (“CRMPS”) has built a first solar-diesel-hybrid power plant in the MW-scale at CRONIMET Chrome SA (Pty) Ltd.’s Thabazimbi chromium mine in South Africa. In PV-diesel-hybrid power plants diesel consumption is reduced through the integration of a photovoltaic power plant. In comparison to traditional grid-connected PV power plants the engineering requirements are much higher. The study “Solar, energy efficiency and load shifting for an optimized energy management in the mining industry” conducted by CRMPS and THEnergy shows the importance of considering both, demand side and supply side at the same time. The study is based on 26 interviews with experts from the mining and energy industries. The experts are from Africa, Australia and Europe.

Substantial electricity and cost savings through an integrated optimization of demand and supply side

Typical cost savings from the PV side are in the range of 25%-30%. In very remote locations with elevated diesel prices the reductions can amount to more than 70%. The study shows that on the demand side energy efficiency measures and load shifting can have substantial effects on the electricity consumption of a mine. Energy efficiency measures can be applied all along the mining value chain as well as for auxiliary applications. The main fields are: compressed air systems, ventilation, material handling, pumping, crushing and milling. Energy efficiency can account for electricity reductions of 5 – 20% and load shifting for energy cost savings of 5-10%. Energy efficiency measures and load shifting schemes have a direct influence on the optimal design of the PV plant. Avoided or shifted energy consumption allows for designing the PV plant in an optimal way. Often the integrated solution decreases the amount of capital expenditure needed for upgrading existing diesel gensets with solar power considerably. “Mining process and solar experience allow for creating tailor-made solutions. In the end the customers profit by spending less”, explains Rollie Armstrong, managing director of CRMPS.

Higher requirements for solution providers

Energy efficiency measures and load shifting require a thorough knowledge of mining processes. It is obvious that the simultaneous optimization of demand and supply side are much more complex than the construction of a traditional PV power plant. A prerequisite for finding the best solution is combining skills from both worlds, from mining and solar energy. In addition, many of the solutions are novel. Many improvements have been developed during the operation of PV-diesel-hybrid power plants at mining sites. A track record of on-site testing helps to implement new solutions in the most efficient way. “The study is an excellent example to show how complexity is increasing if solar energy moves toward major industrial consumers”, points out Dr. Thomas Hillig, founder of THEnergy.

The study can be downloaded at: http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/

June 2015

PV tender for French Islands carries unique potential for storage solutions

New simulation forecasts a potential of up to 50 MWh for energy storage systems in ongoing tender

The cost of electricity generation on the French islands without connection to the mainland grid is particularly elevated. This is why solar and wind energy have been extremely successful in recent years. On average, they contribute approximately 25% to the total electricity generation in these locations. In the meantime, their volatility is considered a risk for the stability of the grid as a whole: this has resulted in a 30% cap for renewable energy in these local grids. At the same time, France has adopted a plan for the integration of solar and wind energy on the basis of stationary energy storage systems.

On May 20, 2015 the French energy regulation commission published a tender for 50 MW solar plants with at least 25 MW/25MWh storage for the French island regions – the total storage piece is likely to be larger, for a total market of approximately 100M€. Innovative elements are included in the tender to ensure that these installations meet the requirements of the islands. The different features are very demanding for the tender participants. In the text for invitation to tender a minimum capacity of 0.5 MWh storage per 1 MWp of PV is defined. In addition, the system consisting of PV plant and storage must comply with certain rules. The PV feed-in volumes are matched to the actual loads. The extreme case is that the solar plant has to be able to provide electricity for peak-load situations in the evening. In addition, the tender contains special requirements for the forecast of time slots that are critical for the grid. For this purpose the operators have to cooperate with several local companies and specialized players.

THEnergy offers simulations for the tender, in cooperation with the French company Clean Horizon Consulting. Among other things, the solution computes for different storage technologies, the optimal design of the storage and the corresponding LCOE (Levelized Cost of Energy) for the PV-storage unit. The simulation addresses project developers, system-integrators and storage manufacturers, who want to participate in the tender. The players gain time, a considerable advantage given the strict time frame of the tender. A solution can be generated within 24-48 hours, which allows the customers to focus on the selection of project partners and specific projects in order to present competitive offers.